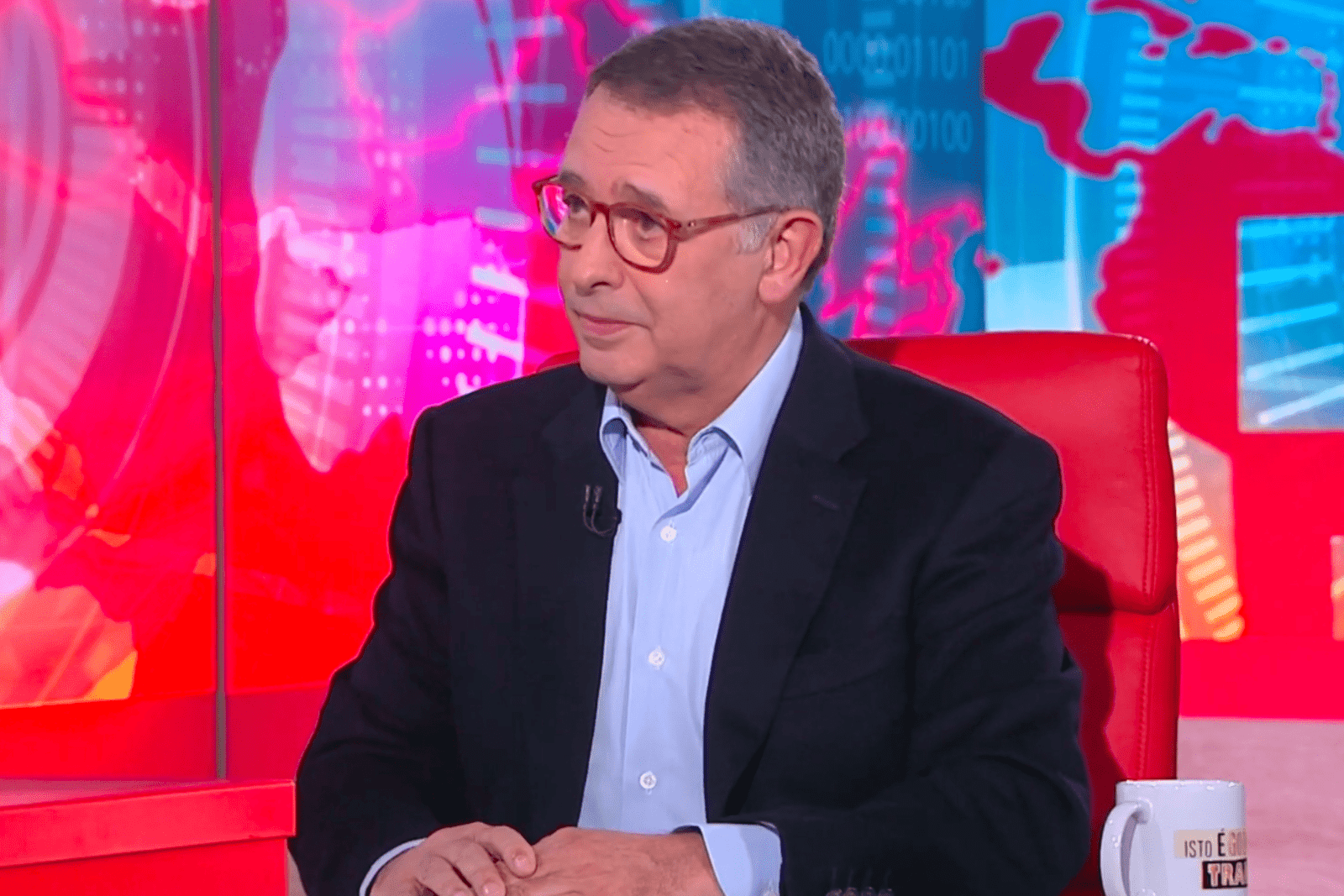

In 2026, Portugal elected its new President of the Republic: António José Seguro. With a moderate profile and a well-established career in national politics, Seguro takes office at a moment of parliamentary fragmentation and broader reconfiguration within the European political landscape.

Although the Portuguese presidency is predominantly institutional in nature, it holds strategic powers — including the ability to veto legislation, dissolve Parliament and influence decisions during periods of instability.

The election comes amid a European political climate marked by polarisation, the rise of conservative forces and structural economic challenges — inflation, fiscal pressure and slowing growth in parts of the eurozone.

Domestically, the government remains led by Prime Minister Luís Montenegro, requiring institutional balance between different political forces.

For the markets, the outlook suggests a delicate combination: a fragmented Parliament, yet a presidency grounded in stability and dialogue.

Stability is a word the markets understand well.

The victory of a moderate figure signals predictability — and predictability reduces risk. This directly affects:

• Foreign investor confidence

• Strategic sectors such as tourism, technology and the financial system

• Trade relations within the European Union

In a world where political decisions reverberate instantly across global markets, Portugal positions itself as an economy seeking institutional balance.

And balance, in the current climate, is a valuable asset.

In the global lifestyle landscape, this matters as well: stable countries attract capital, talent and international events, consolidating their image as strategic hubs for business and innovation.

In an increasingly polarised European context, do you believe moderation and stability remain the strongest political assets for sustaining economic growth?

Or has the market already begun pricing in something different?